georgia ad valorem tax motorcycle

The procedure to be followed for motorcycle registration in Georgia. Georgia Ad Valorem tax Discussion in Victory General Discussion started by Bobbyd85 Jan 14 2015.

Cherokee County Ga Motor Vehicles

February a 1 discount.

. Jan 14 2015 1. This calculator can estimate the tax due when you buy a vehicle. Cost to renew annually.

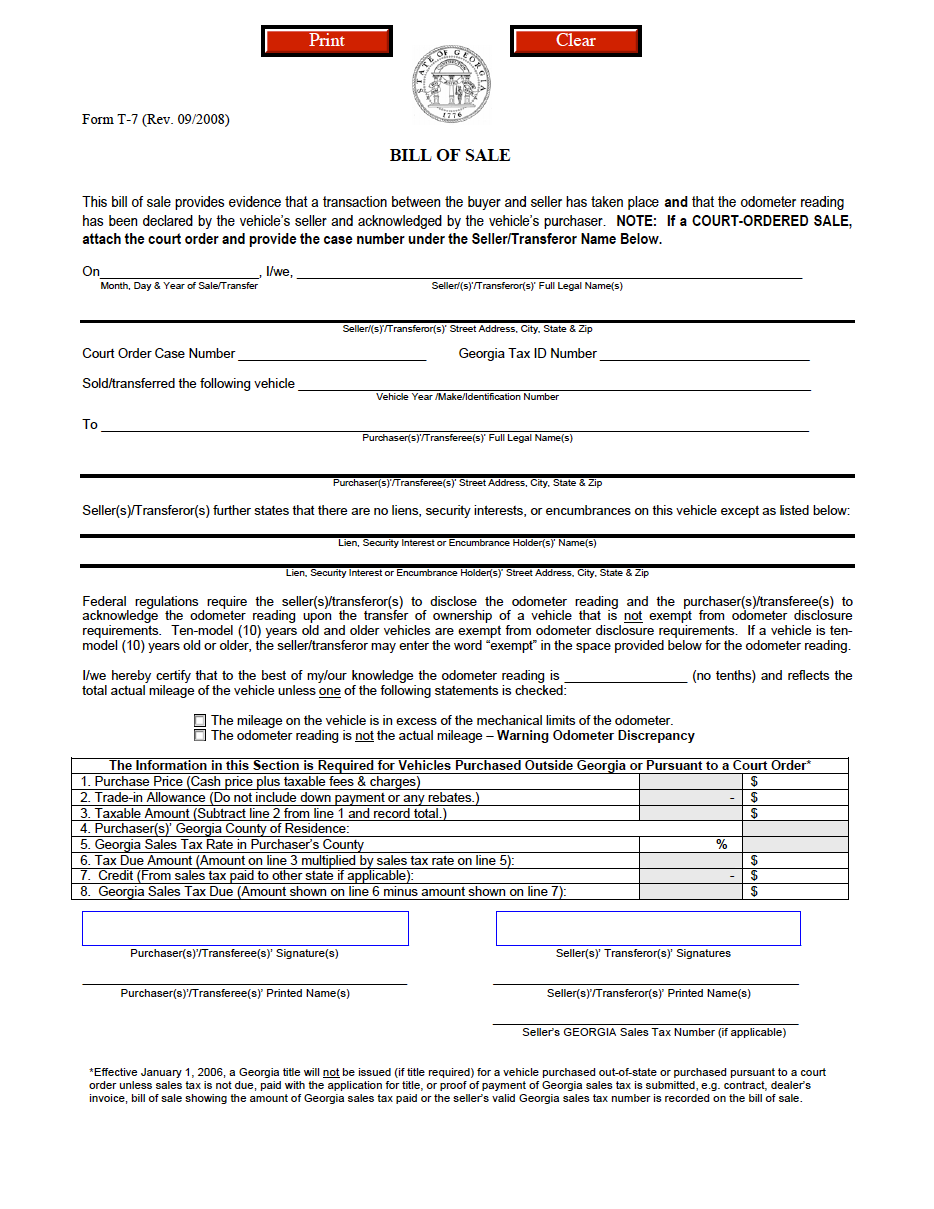

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Registration Fees Taxes. 80 plus applicable ad valorem tax.

January a 2 discount. Property Taxes are payable in November with a 4 discount. As of 2018 residents in most Georgia counties pay a one.

Motorcycles may be subject to the following fees for registration and renewals. Of the Initial 80 fees collected for the issuance of these tags the fees shall. Taxes and penalties specified by Georgia lawAd valorem taxes if due are collected when the.

According to Chapter 22 of Publication 17 the IRS allows you to deduct the ad valorem tax vehicle value off your income taxes. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later.

5500 plus applicable ad valorem tax. Do I have to pay the Georgia ad valorem tax on a leased vehicle. Justia Free Databases of US Laws Codes Statutes.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative. For the answer to this question we consulted the Georgia Department of Revenue. Georgia Department of Revenue gives in depth information on the exact required amount of fee particularly the amount you have to pay as an ad valorem tax which is based on the current.

2021 Property Tax Bills Sent Out Cobb. This will comprise of an annual registration fee of twenty dollars an ad valorem tax eighteen dollars in title fee and. 2021 Georgia Code Title 48 - Revenue and Taxation Chapter 8 - Sales and Use Taxes Article 2 - Joint County and Municipal Sales.

For tax year 2018 Georgias TAVT rate is 7 prtvrny. 2021 New Years Day Friday January 1 November 27 Friday Mandatory Annual Leave. 393 Type of Motorcycle Currently Riding.

Pay Taxes Property Taxes.

Tavt Information Georgia Automobile Dealers Association

Georgia Dealer License Videos For Car Lots

Georgia Motorcycle Registration Vinfreecheck

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Motor Vehicle Division Georgia Department Of Revenue

3 Simple Ways To Register A Car In Georgia Wikihow

Motor Vehicles Forsyth County Tax

Changes In Georgia S Ad Valorem Tax

![]()

Georgia New Car Sales Tax Calculator

Georgia Title Transfer Etags Vehicle Registration Title Services Driven By Technology

Free Georgia Bill Of Sale Forms 5 Pdf

Are There Any States With No Property Tax In 2022 Free Investor Guide

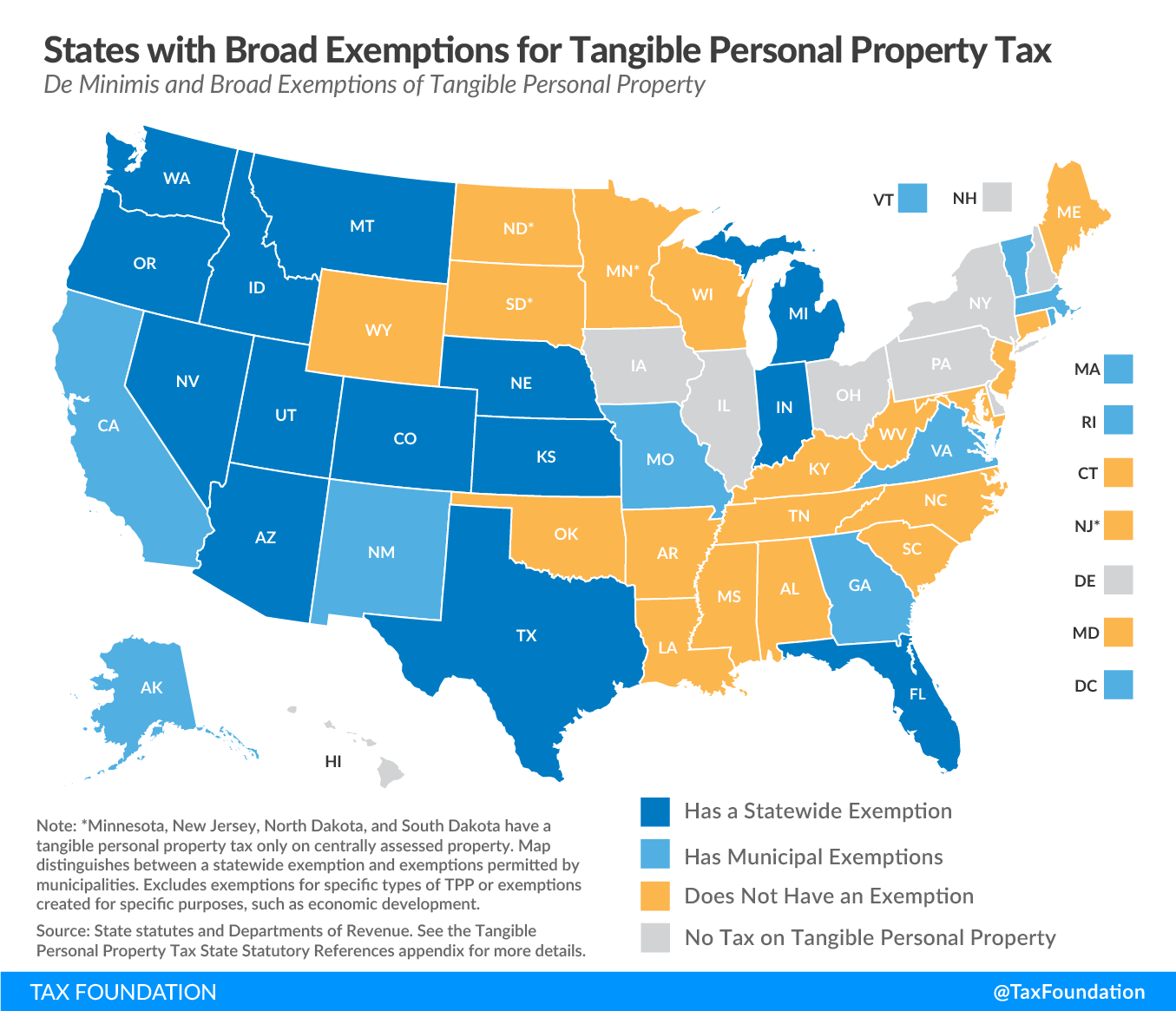

Tangible Personal Property State Tangible Personal Property Taxes

Georgia Department Of Revenue Local Government Services Motor Vehicle Divisions Ppt Download

Dawson County Tax Commissioner Nicole Stewart On Twitter Support Our Troops Tag Initial Purchase Is 80 00 25 Manufacturing Fee 35 Special License Plate Fee 20 Registration Fee Ad Valorem Tax If

Form T 146 Fillable Irp Exemption To Title Ad Valorem Tax Fee Application