ev charger tax credit form

Up to 1000 Back for Home Charging. The charging station must be purchased and installed.

Seven Things To Do After Purchasing Your First Electric Car Charged Future

Its subject to TMT whereas other credits like The EV car credit and Solar credits arent.

. The incentive can be a large percentage of the charger and installation costs. This federal EV infrastructure tax credit will offset up to 30 of the total costs of purchase and installation of EV equipment up to a maximum of 30000 for commercial property and 1000 for a primary residence. Overall claiming the EV tax credit is a pretty straightforward process.

About Form 8911 Alternative Fuel Vehicle Refueling Property Credit. The tax credit is available only to businesses. Another aspect of tax credits for EV charging and other sustainability measures is that often the amount of rebate offered is dependent upon a time limit or by how many rebates have been used.

Individual homes do not qualify. In some areas power companies offer utility credits for drivers who use smart chargers like the TOG EV700 that allow for charge scheduling. Make sure to keep receipts for the equipment and installation of your EV charger.

Just buy and install by December 31 2021 then claim the credit on your federal tax return. Were EV charging pros not CPAs so we recommend getting advice from your own tax professional. You use form 8911 to apply for.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations. Figured it out. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

Basically if you have enough credits for the year even if you still have tax liability and no AMT your TMT will dictate if you will get the EV Charger credit. Youll need to know your tax liability to calculate the credit. This publication is intended to provide general information to our clients and friends.

Residential Energy Credits Form 5695 Part I then. Content updated daily for ev charging station tax credit. If you purchased your EV more than 3 years ago and the vehicle is still eligible for the tax credit you can file an amended return to.

Federal tax credit is also available for 30 of EV charger installation costs for businesses and up to 1000 for individuals. A battery-electric vehicle BEV with a rating of 25 kWh per 100 miles costs approximately 375 dollars per year or 3125 per month to charge at a rate of 10 cents per kWh. Any credit not attributable to.

Use this form to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year. EV Charging Station rebates available for public and private entities in New York. State-based EV charger tax credits and incentive programs vary widely from state to state.

Commercial EV chargers tax credit. You can also review the guidance from the IRS at this site IRS Guidance 8911 or consult your tax advisor. This importantly covers both components on charging costs.

Claiming the EV Tax Credit on Your Tax Return. Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc box 15 code P. Grab IRS form 8911 or use our handy guide to get your credit.

Funded by the California Energy Commission CEC and implemented by the Center for Sustainable Energy CSE the Southern California Incentive Project SCIP promotes access to electric vehicle EV charging infrastructure by offering rebates of up to 80000 for the purchase and installation of eligible public electric vehicle EV chargers in Los Angeles. EV Charging Incentives by State. For more information please contact your BNN tax advisor at 8002447444.

Here are some of the tax incentives you can expect if you own an EV car. You claim the credit on your Federal tax return by completing a form 8911 see the form here. Enter total alternative fuel vehicle refueling property credits from.

The federal government offers tax incentives for businesses to install Level two and three EV chargers. The credit is computed and reported on IRS Form 8911. Under the Biden administration there are high hopes that these EV charging tax credits will continue and even expand.

That could mean up to 30 savings and if your business spends 50000 on EV charger installation you could get up to 15000 back in federal funds. Ad Driving an electric car now comes with added benefits for driving a clean car. Reach out to EV Connect to learn more.

Youll need to know your tax liability to calculate the credit. Residential EV chargers tax credit. The federal government currently offers a tax credit for residential and commercial EV charger installations and hardware costs.

Ad Explore workplace EV charging incentives. Previously this federal tax credit expired on December 31 2017 but is now extended through December 31 2021. Complete your full tax return then fill in form 8911.

Residential installations could have received a credit of up to 1000. You could have received a federal EV charger tax credit of up to 30 of your commercial electric vehicle supply equipment infrastructure and installation cost or up to 30000. However state or province residential charging station tax credits rebates and incentives can be stacked on top of federal incentives.

Electric vehicle chargers - The tax credit allowed is 10 of the cost of the charger and its installation or 2500 whichever is less. Form 6251 is for AMT and is has the calculated TMT or Tentative Minimum Tax. And Schedule K-1 Form 1120-S Shareholders Share of Income Deductions Credits etc box 13 code P.

A qualified charger is one that is rated greater than 130 volts and is designed to charge on-road vehicles. Partnerships and S corporations report the above credits on line 8. Enter 100 unless the vehicle was manufactured by Tesla or General Motors Chevrolet Bolt EV etc To claim your federal EV tax credit you must fill out Form 8936 along with Form 1040.

Tax credits are available for EV charger hardware and installation costs. Qualified Plug-in Electric Drive Motor Vehicle Credit Personal use part Form 8936 Part III. Its called the Alternative Fuel Infrastructure Tax Credit and here is how it breaks down.

The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit. The federal tax credit for EV charger projects was retroactive and you could have applied it to installations. 30 of total installation cost up to 1000.

Youll need to complete IRS Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit when you file. So after your Form 8936 credit is applied to tax any amount of tax remaining will be offset by your Residential Energy Credit. Install costs can account for the majority of the total cost of installing EV charging especially for commercial installations.

30 tax credit up to 1000 for residential and 30000 for commercial. Ad Looking for ev charging station tax credit. If you claimed an alternative fuels tax credit in any tax year that began before January 1 2011 use Form CT-40 Alternative Fuels and Electric Vehicle Recharging Property Credit or Form IT-253 Claim for Alternative Fuels Credit to claim a credit carryover or to calculate any recapture of the alternative fuels credit that was allowed.

Alternative Fuel Vehicle Refueling Property Credit Form 8911.

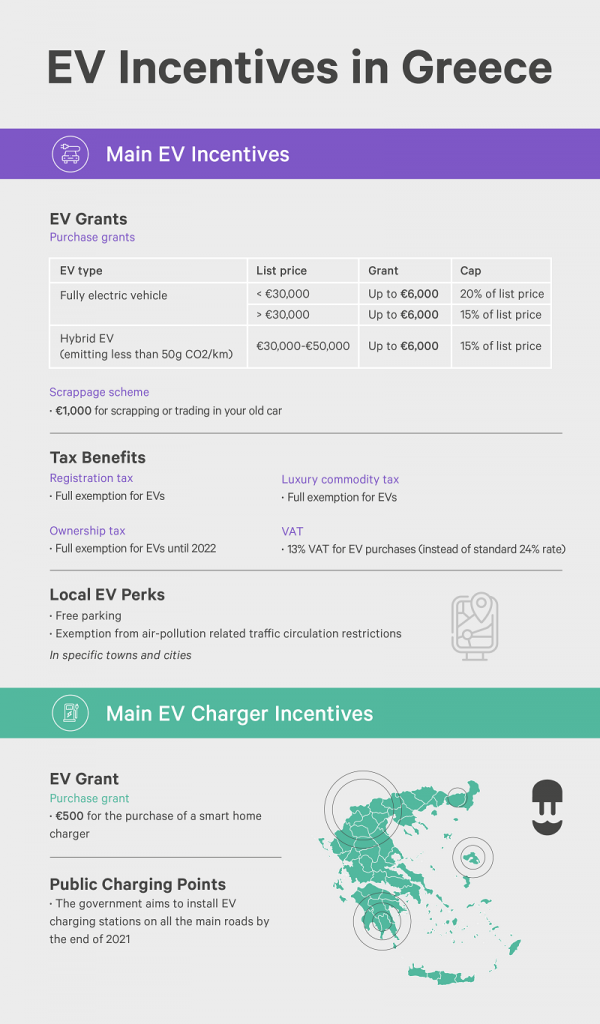

Ev Ev Charging Incentives In Greece A Complete Guide Wallbox

Ev Charge Solutions Ez Pull Cable Retractor 92

Chargepoint Electric Vehicle Charging Station Car Charging Stations Electric Car Charging

Sun Country Highway Clippercreek Ev40p 32 Amp Plug In Ev Charging Station Costco

/cloudfront-us-east-2.images.arcpublishing.com/reuters/E44NXD2Q2VKH7EUUVAGHNOX5FE.jpg)

U S Proposes Standards For Fast Electric Vehicle Charging Projects Reuters

What Is Ev Charging How Does It Work Evocharge

Home Charging For E Mobility Designed By Kiska

Powering Ev Charging Stations With Agrivoltaics Pv Magazine Usa

How We Could Put An Ev Charging Station On Every Lamp Post

Here S Everything You May Want To Know About Umweltbonus Genannt Purchase Premium For E Cars The So Called Env Electric Cars Incentive Used Electric Cars

Commercial Ev Charging Station Installation Tca Electric

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Electric Vehicle Chargers Selection Guide Types Features Applications Engineering360

Evbox Charging Management Software Evbox

U S Proposes Standards For Fast Electric Vehicle Charging Projects Reuters

Charging Nissan Leaf Leaf E Plus Range Charging Time Type How Much Does It Cost To Charge